Africa's Greatest Succession Story

Handing over a business empire to the next generation is no easy feat. Especially in emerging markets where institutions are often weak and challenges run deep. Many businesses struggle to survive or even thrive during the transition due to factors ranging from political instability and limited regulatory protection to high key-man risk and family conflict (arguably the most common disruptor of all).

During my time living in Ghana over the past three years, I had the privilege of befriending several returnee Ghanaians who had come back to help steer their family businesses, whether full-time or part-time. As an Investment Analyst frequently interacting with family-owned businesses, we often compared notes: their efforts to bring structure and systems into one-man-show businesses mirrored the high key-man risks we routinely flagged when evaluating potential investee businesses. We also discussed how they were mitigating the external macro factors typically prevalent in Emerging Markets, specifically currency devaluation, a prevailing topic in Ghana. These interactions inspired me to look deeper into family businesses and succession in Africa.

Despite the challenges family businesses face in “passing the baton” over to the next generation of stewards, there are clear exceptions to the norm. First, there are families that preserve intergenerational wealth by passing down their values and systems. Then there are the outliers, the ones that manage to multiply that wealth through bold leadership, strategic foresight, and a deep respect for legacy. In this article, I explore one of the counterexamples to the norm: The House of Sawiris, a family whose succession story not only defied the odds but redefined them. This is Africa’s Greatest Succession Story.

Why The House of Sawiris Stands Alone

The succession that unfolded within the Sawiris family between the 1980s and 1990s stands as one of the most successful intergenerational transfers in African business history. Patriarch Onsi Sawiris orchestrated a deliberate and strategic division of the Orascom conglomerate among his three sons—Naguib, Samih, and Nassef. What began as a single Egyptian construction company was transformed under their stewardship into multiple globally recognized empires.

Through landmark developments and transactions across Europe and Africa, bold expansions into high-risk frontier markets, and multi-sector diversification, the family built an empire spanning over 30 countries and seven distinct industries, including telecoms, construction, hospitality, mining, and sports. Listings on multiple international stock exchanges and sound portfolio diversification strategies have helped them weather political and economic turbulence. By 2008, their combined net worth peaked at an estimated $36 billion before the global financial crisis. Today, it is estimated to stand just below $20 billion, cementing their legacy among Africa’s most successful business dynasties.

The Sawiris Foundation

“A tree with deep roots can withstand any storm”, this quote from the Dalai Lama epitomises the ethos of resilience that Patriarch Onsi Sawiris had and successfully passed on to his children. Mr. Onsi was born in 1930 into a Coptic Christian family in Upper Egypt’s Sohag. The son of a lawyer, he earned a BSc in Agricultural Engineering from Cairo University and briefly managed the family’s 52-acre farm before pivoting to construction.

In 1952 Onsei & Lamei Co., a road and waterways contracting company was founded. The company grew to become one of the country’s largest contractors until 1961 when it was nationalised and renamed El Nasr Civil Works Company as part of President Gamal Abdel Nasser’s reforms to the Egyptian economy. Sawiris was retained as a state employee at his former enterprise. Frustrated at his subordination, he exiled to Libya.

In Libya, the relentless patriarch founded a new contracting company, one which partnered with international construction companies. During his decade in exile, Sawiris gained exposure to global project standards through his partnerships, learned geopolitical risk management and amassed the capital to send his sons abroad to leading universities.

In 1976, relations between Libya and Egypt deteriorated following the Camp David Accords. This prompted the now veteran entrepreneur to return to Egypt as a new dawn of rule under President Anwar el-Sadat’s Infitah (open door policy) arose. He founded Orascom for Constructions and Trade, as a general contracting and trading company. The Company started with just five employees and grew by rapidly bidding on post-treaty infrastructure projects.

The Sawiris Succession

Between 1979 and 1990, after receiving rigorous engineering and economics training at world class institutions, all three sons returned to Egypt and joined Orascom sequentially. Orascom began to diversify its operations beyond construction to telecommunications, hotels and restaurants. They also opened a branch in the USA, Contrack International (later renamed Contrack Watts), to target US federal projects in the Middle East. Each son was strategically involved in the division that suited his educational background, temperament and demonstrated strengths:

1. Naguib (The eldest son) - With his mechanical engineering and technical administration background from the Federal Institute of Zurich (ETH Zurich), Naguib possessed the technical acumen and risk tolerance suited for the nascent, capital-intensive telecommunications sector.

2. Samih (The middle son) - Samih's engineering management training from Technical University Berlin equipped him for large-scale integrated project management and coordination.

3. Nassef (The youngest) - with economics training from the University of Chicago, Nassef instilled capital allocation discipline. He joined Orascom’s capital-intensive, asset-heavy division (construction).

After several years working within their respective divisions. During the 1990s, the Orascom conglomerate was formally divided into three separate operating companies with independent boards:

1. Orascom Telecoms (Later renamed Orascom Telecom Holdings)

2. Orascom Hotels & Development (Later Orascom Development Holding)

3. Orascom Construction Industries

Patriarch Onsi transitioned to Patriarch Emeritus, retaining an informal advisory role. This astute lateral division eliminated sibling rivalry over control of a single entity and unleashed the entrepreneurial autonomy that would catapult the family’s wealth going forward, as each son would carve out his own empire through a unique value-creation engine.

Naguib Sawiris: The Telecoms Titan turned Gold Evangelist

Naguib Sawiris could give John Malone a run for his money for the title of “Cable Cowboy”. From the mid-90s to 2010, he grew and scaled a single country mobile operator into a pan-Emerging Market and Mediterranean telecommunications powerhouse boasting approx. 120 million mobile subscribers spread across over 15 countries. He achieved this through an aggressive debt-funded expansion strategy centred on first mover advantages in high growth, low penetration markets in Africa, the Middle East and South Asia. In 2011, he strategically merged most of his Telecom operations with Russian Giant VimpelCom in a $6.6B deal, creating the world’s sixth largest mobile operator with 181 million subscribers spread across 20 countries. Following his success in Telecoms, he foresaw that global uncertainty would rise and publicly built a majority gold position in one of the largest gold mining operations in the world and the largest in West Africa.

Orascom Telecom’s Rise

Orascom Telecoms Holding (OTH) was incorporated in 1997 as the dedicated Telecoms unit of the Orascom Group with Naguib appointed Chairman and CEO. OTH’s first major move was to form a consortium alongside Motorola and France Telecom in 1998 to acquire a 51% stake in the Egyptian Company for Mobile Services (ECMS). The consortium would launch Mobinil as Egypt’s first private mobile operator and offer commercial GSM services, marking the beginning of Naguib’s first mover-advantage strategy in action.

What followed was a series of rapid expansion into frontier markets deemed too risky by traditional operators, either through acquisitions or being the first bidder for GSM licenses. Naguib summarised this expansion phase of the Group in the following manner: “You needed to go where they [the Telecoms incumbents] were not willing to go”. This expansion would be supported by a timely (peak of the Dot-com bubble) dual listing on the Egyptian Exchange (EGX) and the London Stock Exchange in 2000, raising approx. $320m.

The first country outside of Egypt where OTH operated was Jordan, where in 2000 they acquired a controlling stake in Fastlink (Jordan Mobile Telephone Services) on undisclosed terms. This was followed by a strategic acquisition of 80% ownership in Telecel International for $213m. This substantially increased Orascom’s presence as they received 12 distinct licenses in Sub-Saharan Africa (DRC, Nigeria, Togo, Zambia etc.) as part of the acquisition. Subsequent markets the Group aggressively entered include: Pakistan, where they acquired a 69% stake in PMCL from Motorola; Algeria, where they outbid France telecoms for $737m to win the country’s second GSM license, establishing Orascom Telecom Algerie; and in Tunisia, where they formed a joint venture which secured the country’s second GSM license for $454m, launching Tunisiana.

From a perception perspective, the two riskiest countries the Group operated in are Iraq and North Korea. In October 2003 during the Second Gulf War, Orascom led a consortium that was awarded two-year GSM licenses for Baghdad and central Iraq from the Coalition Provision Authority. Orascom invested over $250m despite harsh conditions, serving approx. 2.5 million subscribers by 2006. Several years later in 2008, Orascom would launch Koryolink as a 75%-25% JV with Korea Posts and Telecoms Corp (KPTC), representing the world’s first 3G mobile operator in North Korea. By 2012, Koryolink served 2 million subscribers (10% of the country’s population).

Weather Investments – The Mediterranean Conquest

In 2005 amidst Orascom’s emerging markets expansion, Naguib Sawiris seized a once in a lifetime opportunity to diversify his growing Telecoms empire in Europe. Wind Telecommuncazioni SpA, Italy’s third-largest mobile operator with 12.6 million mobile subscribers and 2.3 million fixed line customers was on sale from Italian Utility Company Enel. Naguib partnered with American investor Wilbur Ross and French investor Philippe Nguyen to create Weather Investments, a Luxembourg SPV that would go on to acquire Wind Telecoms for €12.1B ($15B), outbidding PE Giant Blackstone in the process. The transaction was Europe’s largest leveraged buyout to that date and today remains one of the largest leveraged buyouts in European history. To finance the transaction Naguib pledged 50.1% of Orascom Telecom Equity, effectively 50% of his net worth, representing a massive commitment and high conviction. The rest of the transaction was financed with +/- €3.5B in new syndicated facilities, +/- €5.5B of refinanced debt and equity from investor partners.

Following the Wind Italia acquisition, Sawiris sought another opportunity to expand his presence in Europe and create a pan-Mediterranean Telecom empire. In 2007 Weather Investments acquired two Telecom assets for €3.4B ($4.4B) and merged them to create Wind Hellas. At the time of the acquisition Wind Hellas had 3.9 million customers with approx. 28% market share.

The Titanic & The Lifeline

By 2008, OTH (separate from Weather Investments) had transformed into a behemoth, generating +$5.3B in annual revenues with 40% EBITDA margins. Validating the high risk, high reward geographic expansion strategies adopted by Sawiris and team. However, given that over 60% of these acquisitions were funded by syndicated bank debt and project finance revenue backed debt, the leverage profile of the Group was becoming alarming. Indeed, Orascom was among the most leveraged emerging market Telcos with their debt-to-equity above 4x. Given this was post-Lehman Brothers collapse, one would assume it would be impossible for OTH to raise capital for refinancing. Wrong. OTH did the unthinkable and raised $750m in corporate bonds in early 2009 taking advantage of a short refinancing window and leveraging their reputation as quality emerging market Telco. Proceeds went to Opex and Capex, with a portion going towards debt servicing. However, the Group still faced challenges: they had over $2B of debt due between 2011-2012 and still needed cash for capex.

Enter VimpelCom. The Russian Telecoms Giant with operations in Ukraine was looking to reduce its reliance on the Russian market (+60% of sales) and saw an opportune moment to acquire a distressed asset with a strong presence across Emerging Markets. They made an offer to buy Wind Telecom (prev. Weather Investments) for $6.6B and committed to refinancing the Hold Co.’s debt. As part of the deal, Wind Telecom shareholders received $1.5B in cash and $5.1B in VimpelCom shares. With his 50% ownership, Naguib received $3B in combined cash and shares, becoming the largest shareholder in VimpelCom with 20% ownership. Existing Orascom shareholders got diluted with equity in the consolidated Group. Naguib also managed to carve out some assets from the merger including Mobinil (Egypt) and Korylink(North Korea) into Weather Investments II, a separate vehicle post-merger.

The Gold Evangelist

After cashing in on his VimpelCom shares, Naguib sought to diversify his wealth. He chose to do so by investing in the world’s most trusted safe haven asset, Gold. What initially started as a diversification strategy morphed over time into an actively managed gold position. And whilst his empire grew, he repeatedly encouraged others to invest in the precious metal as well, with what now appear to have been prophetic-like visions of the current global economic context.

Naguib made his entry into the gold sector in July 2012 through a $492m acquisition of La Mancha Resources Inc., a Canadian listed gold producer with mines in Australia, Sudan and Cote d’Ivoire. At the time gold was trading around $1,600 per ounce. Rather than just operating the mines, he positioned La Mancha as a strategic force in the industry by deploying the same playbook that fuelled his past acquisitions. In 2015 La Mancha sold its Australian operations to Evolution Mining in exchange for a 30% stake in the combined entity. This deal alone made him the largest shareholders in one of Australia’s top gold miners. Rinse & Repeat, later that same year he sold La Mancha’s Cote d’Ivoire mines to Endeavour Mining for a 30% stake in the company. However, with Endeavour he went a step further: he injected capital to help Endeavour acquire other miners, which helped it become the largest gold producer in West Africa (Mali, Burkina Faso, Senegal, CDI) with 1.2 million ounces of production annually.

In 2018, Naguib shocked the world when he shared in an interview that 50% of his est. $5B net worth (at the time) was in gold. Gold had fallen to $1,300/ounce. Analysts described it as a move with “Kahunas and Conviction” given the high concentration. Naguib publicly laid out his thesis that Gold was a good safe haven in a world with increasing geopolitical instability due to its limited supply. He predicted that Gold prices would rise back to reach $1,800/ounce. In 2020, amidst the COVID pandemic, Gold prices blew past $2,000/ounce, validating his earlier predictions. Following the COVID pandemic, Naguib evolved into a gold evangelist, advocating it as a vital safeguard in times of global uncertainty for any serious portfolio. This wasn’t just talk, he doubled down on his conviction in 2021 by selling his shares in Evolution Mining to institutionalise his strategy and launch the La Mancha Fund in Luxembourg, a $1.4B fund holding his Gold assets. The fund opened to limited outside investors and acts as a long-only Gold fund with a select few positions.

In 2025, Gold prices have risen dramatically reaching all-time highs of more than $4,300/ounce, driven by emerging market central bank purchases and heightened geopolitical tensions. La Mancha Fund today has an est. $3.3B portfolio thanks to its 14.9% stake in Endeavour Mining (West Africa) and 25% stake in G Mining Ventures (Latin America). This is a portfolio with a combined production output of 1.38m ounces, with Endeavour alone ranking in the top 10 miners. Naguib’s early bets, active management, vision and conviction in the physical asset have paid off handsomely, resulting in a Global Gold Empire. As it was written! (Dune II ref.)

Samih Sawiris: The Integrated Destination Developer

Samih Sawiris is a visionary, patient developer capable of transforming underutilized geographies into thriving ecosystems where people can live, work and create meaning. He grew Orascom’s hotels and resorts business from a single Red Sea town in the late 1980s into a multi-country developer of integrated destinations in the Middle East & North Africa (Egypt, Morocco, UAE) and Europe (Switzerland, UK). The Group boasts a vast hospitality portfolio of 33 hotels with 7,000 rooms and more than 100million square meters (sqm) of land across its destinations. Key landmark resorts such as the Andermatt Swiss Alps and El Gouna have collected multiple international awards, underscoring their leadership in key areas such as sustainability, architecture and destination development.

El Gouna: From Desert Dream to Red Sea Resort

In the summer of 1989, Samih discovered an empty stretch of coastline 25km north of Hurghada (Eastern Egypt) while cruising the Red Sea. Despite the area being isolated, he saw the potential for a unique development: a purpose-built town that would blend architecture, hospitality and community. After securing the land concession, Orascom Development would file the masterplan for El Gouna, which means “The Lagoon” in Arabic. Construction began in 1991 and within eight months, the first 30 homes were complete, a 15km access road had been built, diesel generators (2.5MW) were installed and the iconic social epicentre, the Tamr Henna Guesthouse was completed. Due to the ongoing Gulf War at the time, investor sentiment in the Tourism sector was low with only one bank willing to finance Orascom’s Phase One vision. As a result, Samih self-financed 70% of the initial build, demonstrating high conviction in his vision.

El Gouna was built across 20 islands and turquoise lagoons connected by bridges. Orascom Development opened the 1st hotel, Paradiso Hotel, and gradually attracted local and international hospitality brands such as Vesta Hospitality, Movenpick Resorts and Steigenberger Hotels & Resorts to establish a presence. Sawiris hired leading designers and architects to ensure each neighbourhood had a distinct character with an overarching cosmopolitan design. He expanded the resort to include a marina complex, golf courses, a municipal scale hospital, JCI accredited medical centres, a full wastewater recycling system and a 7MGW solar facility. This gradually established El Gouna as a genuine destination and a pioneer in integrated development within the region. El Gouna also launched the El Gouna International Film Festival in 2002 bringing a cultural element to solidify the destination’s identity.

Over the past 35 years, El Gouna has grown into a sustainable, luxury oasis spread across 36m sqm with a permanent population ranging from 15,000 to 25,000 depending on the season.

In 2014, it became the 1st destination in Africa and the Middle East to receive the UN-sponsored Global Green Town Award, honouring cities displaying substantial efforts and progress towards environmental sustainability and a greener community. A recognition of Samih’s early conviction in environmental integration. El Gouna remains Orascom’s flagship development and cash-flow anchor, acting as a key collateral base for financing local projects and having generated over $270m in revenue in 2024.

Growth across Egypt

Following the successful initial rollout of El Gouna in the 1990s, Orascom began replicating the model in other parts of Egypt. Orascom filed to go public on the Egyptian Exchange (EGX) in1998, as part of its strategy to position itself as a leading integrated town developer in the country. The first resort cluster they developed after El Gouna was Taba Heights, a beachfront resort town situated between the red seacoast and the historic Sinai Mountains. Taba Heights is built on a land bank of 4million sqm and boasts various facilities such as hotels, restaurants and cafes, retail outlets, marinas and a medical centre. Over the years, they have built four large scale developments (excluding El Gouna) in the country with the most recent being a vibrant new neighbourhood in West Cairo named O West. Egypt remains the Group’s largest market with a land bank over 50% of the Group’s 100million sqm land bank coverage concentrated in the country.

Andermatt Swiss Alps: Transforming an Abandoned Alpine Town

In 2005 Andermatt, a small military garrison city in central Switzerland’s Uri canton, was facing economic uncertainty and was on the brink of becoming a ghost town. Its golden days as a mining and military hub were over and the youth were moving to bigger cities in search of better opportunities. Samih Sawiris was brought to Andermatt by Swiss diplomats who had witnessed his transformation of El Gouna to see if anything could be done to revive this city that both investors and the Government had given up on. Samih saw promising potential and took on the herculean task of redefining the city after the Swiss Government labelled his proposals too ambitious. He forged a vision to transform Andermatt into a year-round luxury destination.

In 2006, Sawiris acquired substantial land holdings and secured the development rights to Andermatt. He assembled an experienced team of architects and planners to craft a masterplan that would honour Andermatt’s architectural heritage while introducing contemporary luxury. He also worked to get stakeholder buy-in from the local community who initially viewed the project with scepticism and suspicion.

In 2008, Orascom Development Holding AG listed on the SIX Swiss stock exchange, raising approx. CHF218m at an initial issue price of CHF152 per share at an implied market cap of CHF3.6B ($3.3B). This strategic decision did the following:

1) It recognised ODH as an integrated destination developer with multiple operating resorts across Egypt.

2) It provided equity currency and visibility to fuel ODH’s international expansion into new markets.

3) It gave ODH access to Swiss institutional investors with long-duration capital needed to fund Andermatt’s multi-billion CHF capex pipeline. It demonstrated Samih’s commitment to building in Switzerland for the long-term.

ODH rolled out a series of astute diverse projects to transform Andermatt’s attractiveness. The first project launched was The Chedi Andermatt in partnership with Chedi Hospitality Group. The Chedi Andermatt is a five-star luxury hotel with Michelin star dining, a world class spa and an alpine residential complex. The hotel opened in 2013 and thrust Andermatt into the international limelight, attracting 55,000 guests in its 1st year. In 2016, the Andermatt Golf Course opened with an 18-hole, par 72 championship layout. It immediately won recognition as Switzerland’s best golf destination, a title that it has won five times since! (2016, 2017, 2018, 2020, 2023). The course has become a magnet for luxury golf tourism. ODH also built multiple residential complexes consisting of villas and apartments which would later be sold at record breaking prices.

In 2019, ODH applied a strategy straight from the El Gouna playbook. They announced the opening of the Andermatt Concert Hall, designed by architect Frank Gehry. The concert hall became a year-round venue for classical music performances and elevated Andermatt beyond a mere resort, rather as a cultural destination.

Following an over CHF1.5B investment & countless regulatory approvals, Samih’s vision came to fruition. Andermatt has successfully evolved into a year-round luxury destination attracting expats and visitors from around the world: winter brought skiers, while summer brought golfers, hikers and cultural tourists attending the Concert Hall. The town’s population has increased has more than tripled from its initial 1,500 people thanks to over CHF100m worth of properties sold. Achieving this vision required patience with capital – the project only recorded its 1st positive EBITDA in 2020, revealing a 15-year runway that would bankrupt most developers. Andermatt remains Orascom’s key European anchor project.

ODH’s International Expansion

Outside Switzerland, ODH has developed 2x large integrated resorts in Oman and single integrated resorts in the UAE (The Cove in Ras Al Khaimah), Montenegro (Luštica Bay) and the UK (West Carclaze Garden Village). Most of these projects follow the same playbook of deploying long-term capital to create basic infrastructure, anchor hotels and residential properties in relatively underdeveloped areas with high potential. All Egyptian activities remain structured under Orascom Development Egypt, a direct subsidiary of ODH. In FY2024, ODH’s consolidated activities generated CHF631m ($717m) with Profit Before Tax of CHF42.5m ($48.3m).

Handover to the Next Generation

In December 2021 Samih Sawiris stepped down as Chairman of ODH, transferring leadership to his son Naguib Samih Sawiris, while maintaining 51% ownership. His son now had full independence and autonomy to shape the future of the Group. After three years of managing the Group, Naguib decided to delist the Group from the SIX Exchange. Through LPSO Holding, a private family investment vehicle, the family launched a buyback offer @ CHF5.60/share (a steep decline from initial IPO price of CH152/share) in December 2024. The Group’s delisting from the SIX exchange was approved in May 2025 and its last trading day was 5th June 2025. ODE remains listed on the EGX as a subsidiary of ODH. In October 2025, Samih shared that he had transferred all his shares to Naguib, marking the end of a three-decade journey scaling Orascom Development into a global developer of iconic integrated resorts in niche locations.

Don’t count Samih out yet though. Through Casa Orascom, a vehicle separate from ODH, Samih is working with the Senegalese Government to build a sustainable city “Ville Verte” 35km from Dakar with 18,000 housing units on 216 hectares, respecting the coast. This is a promising $900m project with several environmental challenges to address but if there’s one person that can do it, it’s Samih Sawiris.

Nassef Sawiris: The Industrialist Investor

Nassef Sawiris is an operator builder and strategic capital allocator that successfully expanded the Egypt-focused central construction business into an international multi-industry group with diverse activities. In the span of a decade, through a blend of greenfield construction and a targeted acquisition, he grew Orascom’s cement subsidiary into a top 10 global cement producer that would be sold for $13B. Following this divestment, he ventured into fertiliser and industrial chemicals production and leveraged Orascom’s engineering, procurement and construction (EPC) expertise to expand operations in the USA, Europe, the Middle East and Africa. By 2022 the Group had successfully delivered on major projects in its key markets, including one of the largest methanol plants in the world and forming a joint venture in the UAE to create the largest seaborne exporter of ammonia and urea. Over the past two years the Group has been undergoing a large divestment program, selling over $10B in assets to redistribute capital to shareholders and focus on new opportunities. As this growth has occurred, Nassef has diversified his wealth into sports ownership and retail apparel. He is part owner of EPL club Aston Villa and is the largest individual shareholder in Adidas.

The Beginning + Diversification into Cement

Nassef joined the family construction business, Orascom Construction, in the late 1980s and became increasingly responsible for operations and strategy. In 1998, Orascom Construction Industries S.A.E. (OCI) was established as the vehicle that Nassef would lead as CEO, consolidating the Group’s main activities. These activities were mainly contracting in infrastructure and commercial construction (power, roads, buildings) but also in cement manufacturing through their subsidiary Egyptian Cement Company (ECC), established as a joint venture with global cement giant Holcim in 1996. In 1999, OCI raised approx. $600m in equity via a listing on the EGX, making it one of the top 5 biggest companies on the exchange by market cap. That same year, ECC began operations with a 1.5million mt per year capacity plant, marking the beginning of a strategic move into construction materials.

In 2002, OCI launched the “50‑05 Action Plan” targeting 50% of consolidated revenue from outside Egypt by 2005. What followed was an aggressive geographic expansion strategy where OCI built greenfield cement plants from scratch across multiple emerging market countries (Algeria, Iraq, Turkey), leveraging Holcim’s technology and their internal EPC capabilities. In Algeria, they built the country’s first privately owned cement plant in M’Sila. In 2004 they conducted two landmark acquisitions, 1) they acquired a 51% stake in Pakistani Cement Company, which added 2.2million metric tonnes to Group capacity. 2) They participated in a 50/50 leveraged buyout of Belgian BESIX Group, a tier one international contractor with strong capabilities in marine works, concessions and real estate developments & complex buildings (including the Burj Khalifa!!!). The BESIX acquisition transformed OCI into a group with true transcontinental reach, opening European and GCC markets. This geographic expansion was financed by a blend of OCI operating cash flows, non-recourse project finance debt and syndicated loans (e.g. for Algeria they raised a $95m syndicated loan).

By 2007, OCI had a 12-country cement portfolio with annual production capacity of more than 20million mt. Later that year, the cement activities were consolidated into OCI Cement Group and sold to LaFarge for $13B, making it the largest M&A deal in Egyptian history. Nassef became an 11.4% shareholder in Lafarge and joined the company’s Board of Directors, giving him exposure to potential future upside in the combined business. Most of the proceeds from the divestment were returned to shareholders: two cash dividends worth $11B were paid out to shareholders in Q1 2008, exemplifying the incredible value created over 11 years of cement operations.

Fertilisers & Chemicals Expansion

The remaining proceeds from the divestment were allocated to capitalize on growth opportunities in fertilisers and chemicals and to continue expanding the engineering and construction business. OCI’s foray into chemicals would rely more on timely acquisitions than greenfield projects: In 2008 OCI acquired the Egyptian Fertiliser Company (EFC) from Abraaj Capital for $1.6B. EFC was a producer of ammonia and urea with annual nitrogen fertiliser capacity of 700k mt. OCI also took a minority position in EBIC, a 300k mt fertiliser plant and developed a 2million mt Greenfield nitrogen fertilizer complex in a joint venture with Sonatrach, the Algerian state owned oil company. After strengthening its chemicals business in North Africa, it turned towards Europe and the USA: In late 2009 OCI acquired a distressed asset operating legacy nitrogen fertiliser facilities in the Netherlands with combined annual capacity above 1m mt & renamed it OCI Nitrogen. This acquisition helped OCI gain access to the Dutch gas grid and brought proximity to EU end-markets. Two years later, OCI Nitrogen acquired an idle/ underutilized ammonia-methanol production facility in Beaumont, Texas for an undisclosed amount.

In January 2013, OCI NV was incorporated to consolidate the fertiliser and construction assets under a Dutch domiciled holding company. OCI NV listed on the Euronext Amsterdam Exchange, but no new capital was immediately raised. What followed was a massive +$2B financing program to fund new projects:

1) OCI NV raised a $580m in the markets in a convertible bond and equity offer.

2) OCI NV arranged $1.2B in non-recourse project finance debt for a $2B greenfield nitrogen construction project in Iowa (IFCo), with the balance financed with equity.

3) OCI NV took OCI Partners (holding Beaumont facility) public via IPO on the NYSE, raising $315m to fund a refurbishing & debottlenecking capex program. 21.7% of shares were floated on the NYSE, giving it an implied $1.5B market value.

4) OCI NV raised $100m in common equity to fund US greenfield projects.

Construction Growth, Demerger & Dual Listings

In 2015, OCI N.V. demerged its engineering and construction business into a separately listed company, Orascom Construction PLC, as part of a strategic separation of construction and fertilizer/chemicals activities. Orascom Construction PLC shares were admitted to trading on Nasdaq Dubai and the EGX via a dual-listing structure. No capital was raised in the process.

The construction activities of the Group were expanding in parallel to the Chemicals arm, especially in Egypt where the Group chose to venture into higher margin segments such as O&M and renewable energy projects; and the US where the Group was looking to consolidate its presence. In 2012, it had acquired a long-time established general contractor, The Weitz Company to scale its construction footprint across commercial, industrial and data centre segments. By 2018, Orascom Construction would merge The Weitz Co. with Contrack Watts into a single platform, Orascom Construction USA. In the following years, Orascom Construction USA would go on to build numerous assets including a new single terminal at Kansas City International Airport for $1.5B; data centres in Iowa, Arizona and Colorado; and a 1.8million mt world-scale methanol production complex in Beaumont, Texas, one of the largest in the world.

In Egypt, Orascom Construction would build the country’s first Build-Own-Operate wind farm with 262.5 MGW capacity in Ras Ghareb and would be selected as one of the three primary infrastructure contractors for the New Administrative Capital (NAC), a transformational $58B project serving to ease congestion in Cairo and develop modern government and business hubs. For the NAC, Orascom has already delivered a 4,800MGW power plant, several government buildings and two distinct data centres.

Abu Dhabi, the new epicentre

In 2019, Nassef took the 1st step in redirecting his empire towards Abu Dhabi as the new epicentre of his interests. OCI NV announced a Joint Venutre with Abu Dhabi National Oil Company (ADNOC) to form Fertiglobe, the largest seaborne exporter of urea and ammonia combined with 6.6million mt per year and the largest fertiliser producer by capacity in the MENA region. In 2021 Fertiglobe went public on the Abu Dhabi Securities Exchange (ADX) raising approx. $795m by floating 13.8% of its shares, implying a $5.8B market cap. Two years later in 2023, Nassef announced that NNS Group, his single-family office and private investment vehicle, would relocate from London & Luxembourg to the Abu Dhabi Global Market, the international financial centre of Abu Dhabi.

The relocation would also mark a new era for his companies, in late 2023 he announced the beginning of a large scale divestment program with the objective of liquidating legacy fertiliser and methanol assets, return capital to shareholders and reposition his companies by merging them to create an Abu Dhabi based infrastructure platform, leveraging existing EPC strengths to invest +$50B primarily in the USA. Between August 2024 and now, the divestment program has resulted in $11.6B of assets sold. IFCo, the large nitrogen fertiliser plant in Iowa, was sold for approx. $3.6B to Koch Industries and OCI’s 50% stake in Fertiglobe was sold to ADNOC for $3.6B. When these two deals closed, OCI paid an extraordinary distribution of $3.3B to shareholders in Nov. 2024 via a capital repayment. In 2025, OCI has paid out $1.7B to shareholders through capital repayments and normal dividends. This reflects Nassef’s philosophy of returning capital when intrinsic value has been realised rather than hoarding cash.

In December 2025, OCI NV and Orascom PLC announced their intention to merge. OCI NV will be delisted from the Euronext Amsterdam and become a subsidiary of Orascom Construction, which migrated to the ADX in September and remains listed in Egypt. The merger will mark the beginning of a new era for Orascom Construction, one leveraging over 20 years of world-scale EPC execution and sound capital allocation to focus on what Nassef considers “the biggest opportunity, which is infrastructure”.

Diversification

Beyond being a builder operator in construction & fertilisers, Nassef is also a contrarian investor that has built a portfolio of mature global brands by capitalising on periods of operational distress and market dislocation, acquiring iconic assets at significant discounts to their intrinsic value. The most prominent ones being Aston Villa & Adidas.

Adidas: Value Play

Nassef acquired a minority 6% stake in Adidas in October 2015 for an est. $1.1B. At the time, Adidas was operating in a period of weakness: their stock was down 38% in 2014 due to market share losses to Nike and a turnaround plan was underway under CEO Kasper Rorsted. 10 years later, as Adidas had regained market share in select categories his position had appreciated by an est. $1.2B (excluding dividends) and he has sold of 1.5%, materialising minor gains. He is still a shareholder today and is a member of the Supervisory board.

Aston Villa Turnaround

In 2018 Nassef partnered with American Private Equity investor Wes Edens and formed the NSWE (Nassef Sawiris Wes Edens) investment vehicle which acquired 55% of Aston Villa FC for £30m ($40m). Aston Villa was going through challenging times: they were playing in the Championship League after being relegated in the 2015-2016 season and they were facing a liquidity crisis on the brink of insolvency. Just like with Adidas, Sawiris and Edens saw an undervalued asset with turnaround potential. By August 2022, they had invested £360m to acquire full ownership in the club, own the Villa Park stadium outright and clear legacy liabilities. Additional investments were made to sign star and up-coming players and strengthen the club management.

As new owners, they have successfully revived the club. Aston Villa re-entered the English Premier League in the 2020 season and qualified for the Champions League after finishing 4th in the 2024 season, the first time since 1983, ending a 41-year drought. The financial performance of the club and valuations have also grown in sync with Club performance: Revenue has grown from £115.7m before they took over to £275.7m in 2024, a 138% increase. The club was initially valued at £54.5m and is estimated to have been worth £690.9m in 2024, representing a 12.68x gain. Their next challenge as owners will be to achieve profitability as the club is still loss-making.

On Resilience

“A smooth sea never made a skilled sailor”. The ascension of the Sawiris family has not been without setbacks and blows, however through their faith, the values instilled in them by their parents and their unique structure, they have been able to weather challenging political and economic storms that have tested them at every turn.

Algeria Djezzy Dispute

When OTH entered the Algerian market, they outbid France Telecom by $300m and paid $737m to win the country’s second GSM license. Djezzy was the brand name of the company, and it was OTH’s most profitable subsidiary, achieving an incredible 70% market within one year of their 2002 launch. The Average Revenue Per User (ARPU) was approx. $9, 4x higher than the GDP per capita in the country at the time. Djezzy was a flagship asset for OTH, it maintained its leadership position in the market with estimates that they had around 15m subscribers at peak. OTH invested approx. $1.7B between their entry in the country and 2011. However, from 2008 onwards government sentiment towards Djezzy shifted for the worse.

Between 2008 and 2011, the Algerian government went on full offensive mode towards OTH to nationalise OTA (Orascom Telecom Algeria). They issued provisional tax reassessments worth $820m, blocked OTA from issuing dividends to its parent entities and imposed a $1.3B fine on OTA for alleged FX violations. The government also forced OTA to shutdown its international communications network, imposed a customs blockade on goods essential to OTA’s operations and blocked a bid for OTA from regional competitor MTN. The consequences were such that when the Vimpelcom-Wind Telecom merger took place, these regulatory pressures & potential takeover threats severely impacted the overall valuation of Wind Telecom. As a result, analysts and Naguib believe Wind Telecom sold far below its fair value. Naguib took the Algerian Government to the International Permanent Court of Arbitration (PCA) seeking damages of $5b for expropriation and unfair treatment. A settlement agreement was reached for an undisclosed amount. Still, the damage had been done.

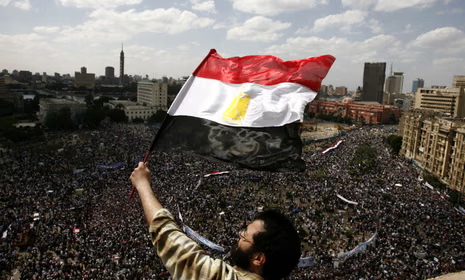

Muslim Brotherhood Repression

Following the 2011 Egyptian Revolution, Naguib became a vocal liberal political figure, advocating for more democratic secularism in the country and founding the Free Egyptians Party. This went against the pro-Islamist agenda of the Muslim Brotherhood, that had seized power. Naguib leveraged his media assets (ON-TV satellite channel and stake in Al-Masry Al-Youm newspaper) and political party to openly criticise then President Mohammed Morsi. In retaliation, the Government targeted Orascom Construction Industries with a large tax-evasion case. Amidst the rising pressure, Patriarch Onsi and Nassef went into exile in London. This would mark the second time the Patriarch would leave the country. Naguib was also in self-imposed exile. They would eventually return to Egypt after mediation efforts with Muslim-Brotherhood affiliated businessman Hassan Malek, but the country would no longer be their main area of residence. The tax evasion case was dropped after Naguib sold his satellite channel ON-TV, a key condition. Naguib is alleged to have played a role in the downfall of Mohammed Morsi, supposedly financing the campaign which led to the end of his mandate.

Tourism Collapse: ODH Restructuring

The 2011 Egyptian Revolution and short reign by the Muslim Brotherhood collapsed the tourism industry. Visits from international tourists dropped from 14.7m in 2010 to 9.5m in 2012. Hotels and resorts alike saw occupancy rates plunge sub 10% towards zero. ODH was severely impacted: Hotel revenues declined and real-estate sales dried up as political uncertainty removed all appetite from local and international investors. Orascom Development Holdings had to take drastic measures to survive.

Between 2012 and 2013, Orascom management laid off 2,400 employees (approx. 17% of its global workforce). Payroll was the Group’s biggest cost item and the reductions would result in CHF38.5m in annual cost savings. The Group also established a new company Orascom Hotels Management with the aim of extracting maximum value from its +30 hotel portfolio and implementing best-practice benchmarking across all properties. The most significant measure the Group took was to transfer majority control of Andermatt Swiss Alps from ODH to Samih Sawiris personally. As the project was still in construction phase, it was burning cash. The CHF110m in shareholder loans from Sami were converted to equity. This improved the company’s financial position too, reducing net debt from CHF500m to below CHF400m. This move also gave Sawiris the freedom to continue investing in Andermatt through his own vehicles, which he did.

ODH management negotiated debt restructuring and covenant relief with their lenders, giving them further medium-term headway. These painful measures enabled the Group to avoid the slow-motion collapse that befell many tourism dependent companies in the aftermath of the Arab Spring.

Currency Mismatch

One of the most challenging aspects of having your principal activities in emerging markets is the increased risk of local currency volatility and devaluation. This is a challenge operators and investors know far too well, and the Sawiris are no exception. With the majority of ODH’s revenues derived from their activities across Egypt, the Egyptian pound’s repeated sharp devaluations and volatility against major currencies has been one of the key drivers of shareholder value erosion. ODH went public @ CHF152/share and delisted around CHF5/share, highlighting a significant drop in its 17 years as a public company. This decline is in no ways representative of the underlying business excellence and operational performance of ODH within that period and was likely one of the considerations for Naguib Samih Sawiris to delist the Group Holdco from the SIX Exchange.

On Values & Philanthropy

Values are like intangible assets. We don’t see them yet they’re often the deciding factor in whether a family business merely survives or truly thrives through succession. As devout Coptic Christians in a Muslim-majority country (10% minority), the Sawiris brothers credit their Mother, Yousriya Loza-Sawiris, for instilling in them the “Love and Fear of God”. Eldest brother Naguib has spoken repeatedly on the importance of faith in his life, once telling former interviewer Charlie Rose: “What gives me strength and confidence is my belief in God”.

The Matriarch also played an instrumental role in shaping their lifelong philanthropic approach, taking them to less fortunate parts of Cairo in their early childhood to donate toys instilling in them a sense of responsibility and giving back. Their philanthropic work formalised in the 2000s through two separate ventures:

1) The Sawiris Foundation for Social Development: Over $90m invested in more than 500 projects reaching over 850k beneficiaries since inception. Projects include $6.3m to fight coronavirus or the establishment of 45 community schools in Upper Egypt.

2) Onsi Sawiris Scholarship Program: Providing fully funded scholarships for Egyptian students at prestigious US universities. Since inception over 100 students have received financing through the program. The endowment is funded by OCI, while benefitting from cross-family contributions.

Beyond giving back, these foundations institutionalised stewardship within the family and created aligned incentives. With all three sons serving on the Sawiris foundation board, they had a separate governance forum for value alignment.

Lessons

There are many lessons that family business stewards and aspiring entrepreneurs like myself can draw from the handover and ascension of Sawiris family empire. While they had a foundation to build upon, each brother ultimately built entire divisions and companies from scratch.

Adapt Your Succession Approach

Most families follow a vertical succession model where a single heir or joint heir manage a unified entity. The Sawiris chose to divide the Group laterally, splitting the conglomerate into three independent empires based on each son’s strength. This avoided the family conflict we have seen from families like the Lee Family (Samsung) or the Ambani brothers. This approach multiplied the wealth creation potential and diversified family risk across sectors/geographies. The Sawiris have demonstrated that a succession model adapted to family circumstances is what ultimately leads to success.

Fortune favours the bold

To call the Sawiris bold feels like an understatement. All brothers took major bets along their respective journeys that would make others shiver with anxiety. Naguib leveraged 50% of his OTH shares (net worth) as collateral for the Wind Telecom LBO to enter a completely new market. The Swiss government thought the plans Samih had proposed for Andermatt were too ambitious and declined to execute his recommendations. Samih took it upon himself to execute the vision. ECC was so confident in their EPC capabilities that they chose to build cement plants in other emerging market countries from scratch as opposed to acquiring existing ones (except Pakistan).

Strategic partnerships are key

The Sawiris demonstrated a canny ability to form and manage partnerships to create mutual value. The examples that come to mind include: 1) Fertiglobe, the Joint Venture between OCI NV and ADNOC that created one of the largest urea exporters. 2) The partnership between Nassef Sawiris and Wes Edens to form NSWE which owns English Premier League club Aston Villa and Portuguese Primeira League club Vitória S.C. 3) The partnership between Naguib Sawiris, Wilbert Ross and Phillipe Nguyen to create Weather Investments as a separate vehicle owning both OTH assets and Wind Telecom ultimately facilitated the merger with Vimpelcom.

Competition Is for Losers

One of the key takeaways from Peter Thiel’s Manifesto Zero To One is that Competition Is For Losers. The Sawiris deliberately avoided competing in markets where they felt they lacked an advantage, both Samih and Naguib expressed this in interviews. Naguib explained that he “had no choice” when explaining his rationale for entering into markets that were deemed too risky from incumbents. Similarly, when reflecting on his development projects, Samih explained that “the fear of competing was always the driver in the search for something that no one has done or is doing”.

Seize opportunities by the horn

Warren Buffet famously said “Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.” The Sawiris operated by this philosophy, they seized opportunities that presented themselves as soon as they recognised their potential. 1) Wind Telecom was being sold by Enel in a competitive bidding process. 2) OCI acquired two different distressed assets as part of its nitrogen-fertiliser build up plan. 3) The area for the “Ville Verte” project in Senegal was initially allocated to Rapper Akon for his futuristic Akon City concept. However following Akon’s inability to raise the financing required to execute it, Akon City has been scrapped and Samih has been brought it in to work on an entirely different concept, “Ville Verte” which translates to Green City.

Do not shy away from public markets

Many families in African Markets choose to stay private. The Sawiris brothers did the opposite and listed their companies on 7 different stock exchanges (LSE, SIX , Amsterdam Euronext, ADX, EGX, Nasdaq Dubai, NYSE). Each of their initial divisions was listed at home in Egypt, with subsequent listings varying according to the strategic rationale. Being listed entities enabled them to access the necessary capital required to fuel their growth and expansion plans. OCI NV is a great example of this, the Group has raised approx. $5.5B via bond issuances since its listing on the Euronext in 2013, through a blend of senior secured and unsecured notes. Being listed has allowed the Sawiris to maximise liquidity, attract an institutional investor base, facilitate international syndicated loans and professionalise their businesses. However as observed with ODH, it can have long term negative consequences depending on the market where the listing has taken place.

Geographic diversification is necessary

All three brothers succeeded in diversifying the Group’s activities. More importantly they successfully diversified the Group’s operations beyond Egypt to reach over 30 countries across six continents. They successfully did this while maintaining a key presence in their home market. From OCI’s “50-05 Action Plan”, we see that this was a deliberate effort and based on the challenges that emerged amidst the Egyptian Revolution and the aftermath, we can understand why. Geographic diversification enabled the family to cushion multiple shocks they faced and ultimately preserve their wealth and assets. A global mindset is also what has allowed the Family to grow their empire beyond the pyramids of Egypt to the rivers of Kansas and all the way to the mountains of North Korea, just as globalization was increasing across the world.

Capital Allocation & Transaction Sophistication

The Sawiris operated like US private equity tycoons from the 1980s, executing some of the largest and most complex transactions in their respective markets/sectors. Few African families have demonstrated comparable M&A sophistication, capital markets access, strategic exits and capital recycling.

Fin

The Sawiris family succession transformed a single Egyptian construction firm, twice destroyed by nationalization and exile, into a global empire spanning telecoms, real estate, construction, fertilizers, mining, and sports. Despite facing geopolitical challenges, the family has uniquely achieved multi-sectoral, multi-continental dominance while maintaining family control, a rarity in Africa.

The Sawiris family succession is not merely a story of wealth preservation. It is a narrative of wealth multiplication, entrepreneurial autonomy, global ambition and generational values transmission executed against challenging political-economic circumstances. This combination undoubtedly renders it the greatest family business succession in African history.